Solved: How do I manually enter employer payroll liabilities into Quickbooks online?

14 Dec2020

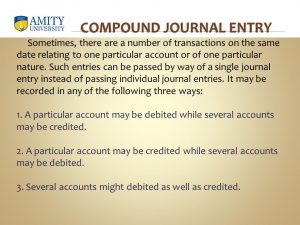

This meticulous process helps maintain accurate and compliant payroll records for the organization. I am experiencing the similar issues with adjusting payroll tax liability. Quickbooks tech support completely messed up Federal Unemployment tax settings when they tried to change rate from 6% to 0.6% and screwed State unemployment tax settings as well. For almost a month they still have not fixed it and stopped responding for the case. I had to produce and file quarterly tax reports manually and now have to do some sort of adjusting J.E.

Create a Backup Of Your Company File

Quickbooks helps businesses manage payments, pay taxes, run payroll, and settle any liability for the businesses. The application works on the data entered by users, making mistakes on their part is very natural. That is one big reason why intuit developers added an option to adjust payroll liabilities in QuickBooks. The users what is a chart of accounts a small business bookkeeping guide can use the payroll adjustment liability feature to correct employees’ year-to-date (YTD) or Quarter-to-date (QTD) payroll information. Users can also make changes in company contributions, employee additions, and deductions. So, we have enclosed this blog with what payroll liabilities are in QuickBooks and how to adjust it.

How to Change Payroll Liabilities Schedule in QuickBooks Desktop?

This involves carefully updating each employee’s hours, wage rates, and any other relevant information in their respective payroll profiles. After making these individual adjustments, it’s essential to reconcile the payroll records with the amounts owed to avoid any discrepancies. Yes, as my colleague mentioned above, you can pay your payroll liabilities outside via ACH and then record them in QBO. I’d also suggest consulting an accountant to advise you on the most suitable setup for your business structure. Last night I discovered that one of my biggest issues is that Payroll has been recording the paychecks in the “Operating (233)” register.

How To Set Up Direct Deposit In Quickbooks Desktop

Now that you understand the process of adjusting liabilities through the Payroll Center, you can proceed confidently with making any necessary adjustments to your payroll liabilities in QuickBooks Online. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. Learn more about how we rate small-business accounting software.

Related Posts

The available payment options for settling payroll liabilities vary between QuickBooks Online and QuickBooks Desktop, influencing the efficiency of online payments and the overall processing of payroll obligations. Understanding these distinctions is pivotal for selecting the most suitable platform. By setting up scheduled payments, businesses can ensure that their payroll liabilities are consistently funded, avoiding potential penalties or interest charges due to late payments. This also promotes financial planning and organization, as it allows for the predictable allocation of resources for upcoming tax liabilities. Implementing scheduled liabilities payments in QuickBooks Desktop streamlines tax filing processes and compliance adherence by automating the timely allocation of funds towards payroll liabilities.

How Do I Show a General Journal Entry for Company Deductions From Employee Payroll?

If you use QuickBooks Desktop Payroll Assisted, contact us if you need to make an adjustment for a previously filed tax form or payment. I understand this isn’t an easy process for you, @heatherhd14. I’ll direct you to the right support who can help you further with Payroll Tax Liability adjustments. Sadly, I cannot see your screen shot (don’t know if it’s my computer or QBO keeping us from seeing it), but I appreciate your insight. It is so frustrating that QBO has tied the hands of the accountants who should be able to adjust these things. And I agree, when you do get on the line with someone, 85% of the time you know more than they do.

Regarding tax deadline management, QuickBooks Online‘s automated reminders and filing assistance stand out, whereas QuickBooks Desktop requires more manual tracking. These disparities contribute to the distinct experiences users encounter when managing payroll liabilities in each platform. Users can access the Pay Liabilities feature to calculate taxes accurately, including federal and https://www.quick-bookkeeping.net/ state payroll taxes. QuickBooks Desktop provides support for a variety of tax forms, making it easier to stay compliant with tax regulations. The system allows for electronic payment processing, further simplifying the settlement of liabilities. With QuickBooks Online, businesses can easily set up recurring payments for various payroll obligations such as wages, taxes, and benefits.

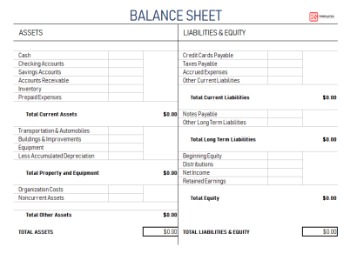

The software allows for customization of payroll items to suit specific business needs, contributing to meticulous financial record-keeping. Establishing payroll items within QuickBooks Online involves configuring essential components such as employee records, automation of transactions, and categorization of payroll expenses. This process streamlines the recording and management of payroll-related data. This recalibration process involves carefully reviewing the previous calculations, identifying any discrepancies or errors, and then correcting these figures to reflect the accurate tax withholdings and liabilities. Once the incorrect amounts are identified, the next step is to zero them out and reconcile the adjusted figures with the company’s financial records. The initial step in adjusting payroll liabilities in QuickBooks is to identify the specific reasons or events that necessitate the adjustment, such as corrections in tax calculations or changes in employee wage withholdings.

- Unfortunately, this only solves part of the problem, as I DO need it to post to my check/bank register.

- It helps you follow basic accounting principles so that you can keep your books up to date and in order, which is especially important come tax season.

- If you are not sure what steps to take, always consult an accountant/tax consultant for assistance.

- The state adjusted the unemployment tax in the middle of the quarter so the taxes due were lower than what is in Quickbooks.

- These adjustments will ensure that your financial records accurately reflect the changes you need to make based on the review conducted earlier.

When you have unpaid wages or withhold amounts from payroll, you’re creating payroll liabilities. It is ridiculous that payroll taxes cannot be adjusted in the https://www.personal-accounting.org/6-types-of-activity-ratios/ online but you can in desktop. The state adjusted the unemployment tax in the middle of the quarter so the taxes due were lower than what is in Quickbooks.

I am wondering when Intuit changes its approach to the development of QBO to make it user friendly allowing accountants to do their jobs accordingly. Current design creates the issues that even tech support can not solve in timely manner. Create Prior Tax Payment choose your tax type and your period dates. I didn’t put in a check number, but I did notes and payment date. I have checked this and it does not show up under the bank register or under the vendor. Please let me know if you have other questions or concerns with payroll taxes.

Other Similar Publications:

- QuickBooks Online Pricing And Plans 2024 Guide

- Accounting Reconciliation: What It Is, How to Do It, and Best Practices

- What Does M And MM Mean In Accounting?

- Church Management Software for Small and Large Churches

- Obtaining an ITIN from Abroad Internal Revenue Service

- EMI Calculator- Home, Car and Personal Loan EMI Calculation

- Solved: How do I manually enter employer payroll liabilities into Quickbooks online?

- Accounting for Property Managers: Beginner’s Guide 2024

- QuickBooks Desktop, Compare QuickBooks Desktop to Online

- The difference between an expense and an expenditure

- Sales tax calculator for 94538 Fremont, California, United States in 2024

- In: Bookkeeping