QuickBooks Desktop, Compare QuickBooks Desktop to Online

6 Aug2020

Intuit typically offers deals where new users can get a discount on QuickBooks Payroll by bundling it with a QuickBooks Online subscription. This service gives you access to a QuickBooks debit card, cash flow forecasting, written down value method wdv of depreciation and QuickBooks Envelopes, which is a place to set aside savings. The QuickBooks Online Simple plan costs $30/month and supports one user. We’ve got you covered with a breakdown of the four QuickBooks Online (QBO) plans.

QuickBooks Online Simple Start Pricing

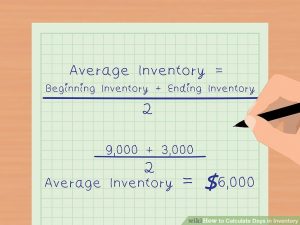

Plus includes inventory accounting that allows you to monitor stock items and quantity—a necessity if you’re selling products. It also lets you update inventory costs and quantities, separate taxable from nontaxable items, and set up alerts if you’re running out of stock. Most importantly, Plus will separate the cost of your ending inventory from COGS using first-in, first-out (FIFO). You’ll need to make this tedious calculation in a spreadsheet if you choose a lower-tier plan. QuickBooks Plus is a substantial upgrade compared to Essentials. The main differences between the two QuickBooks plans are the ability to create billable expenses and assign them to customers, track inventory costs, and calculate P&L by project.

Get to know QuickBooks Online

If you’d like additional help, there are tutorials available on a wide range of accounting terms, skills and how-tos in our QuickBooks Tutorials section. You can also visit our Learn and Support page to search by topic. While QuickBooks Self-Employed is a passable income-tracking and invoicing app for the self-employed, it’s pricier than other freelance-friendly accounting tools like Wave Accounting and Xero. For an extra $50, sign up for a one-time live Bookkeeping setup with any of its plans.

Can I switch from QuickBooks Solopreneur to any higher version of QuickBooks Online?

- Nearly 70% of business owners who have been there, done that, recommend writing a business plan before you start a business.

- Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits.

- QuickBooks Plus is the most popular plan for businesses since it includes features such as inventory tracking, project management and tax support.

- Subscription clients in QuickBooks Desktop 2023 (R1) or older versions will need to update to the latest 2023 (R3) version before their subscription expires.

Through face-to-face conversation with QuickBooks users, we’ve compiled some common QuickBooks questions and answers. We can also offer deals on the best payroll software solution on the market. Whichever service you use, you’ll want it integrated with your accounting software to automate your tax process. You can get a 30-day free trial to use the software (if you do so, you won’t receive any time-limited promotional pricing for new users). Once it expires, you will no longer have access to the information, unless you pay for a subscription.

Use the apps you know and love to keep your business running smoothly. However you work, no matter what your business does, QuickBooks has a plan for you. Get a feel for what https://www.personal-accounting.org/double-entry-what-it-means-in-accounting-and-how/ QuickBooks can do and try out top features using our sample company. If you didn’t receive an email don’t forgot to check your spam folder, otherwise contact support.

More payroll coverage

We believe everyone should be able to make financial decisions with confidence. Advanced Inventory is included in the Platinum and Diamond subscriptions only. Advanced Reporting is included in all QuickBooks Desktop Enterprise subscriptions. Banking services provided by our partner, Green Dot Bank, Member FDIC. A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting.

Once you have a handle on day-to-day use of the QuickBooks Online accounting software, try adding a few more tips and tricks to help you get the most out of the experience. Tax season arrives for everyone, and your business should be prepared ahead of time. Find out which tax deadlines are relevant, depending on the federal, state, and local regulations that may apply to your operation.

If you are self-employed and report income on Schedule C of your personal income tax return, the QuickBooks Self-Employed plan will likely make the most sense. Consider what the system’s interface looks like, how the navigation works and what setup entails. Your familiarity with accounting concepts and the availability of customer support is also worth weighing. Advanced Pricing / Control , customize, and automate pricing is included in the Platinum and Diamond subscriptions only.

QuickBooks Desktop pricing is based on an annual subscription model. Unlike QuickBooks Online plans, which each come with a set number of users, QuickBooks Desktop Premier Plus comes with one user license. QuickBooks Desktop Premier Plus includes a full list of basic bookkeeping tools and features.

Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll. QuickBooks Online customers can also set up automatic recurring invoices, send invoice reminders and accept tips via the invoice, though only QuickBooks Online Advanced customers can send batched invoices. QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a 30-day free trial or 50% off discount just as they can with QuickBooks Online.

A monthly fee will be applied according to the plan you choose. Each can help small-to-mid-sized business owners get a handle on their company’s accounting. Locally installed basic bookkeeping tools, including invoices, industry-specific reports, time tracking, inventory management and more.

Some of the other 20-plus built-in standard reports available include P&L by month and customer, quarterly P&L summaries, and general ledger. If you want a dedicated expert to handle your ongoing bookkeeping work, you can sign up for QuickBooks Live Bookkeeping, available in Simple Start and higher plans. Read our detailed review of QuickBooks Live Bookkeeping to learn more about this assisted bookkeeping add-on. Our internal case study compares the four standard QuickBooks Online plans for small businesses across major accounting categories and functions to help you decide which one fits your needs.

If you want to learn more about QuickBooks, read our complete QuickBooks Online review or get started with a free trial. There are other QuickBooks Online charges in addition to the monthly subscription fee. Here’s a complete breakdown of what’s included with each QuickBooks Online pricing plan. If you do get stuck, QuickBooks Online help is easily accessible from within the application, or you can check out the various QuickBooks Online training options offered by Intuit. In order to make your invoices stand out to your customers and get paid quicker, be sure to set up your invoice preferences prior to sending out your first invoice.

These features are available in every QuickBooks Enterprise subscription. In addition to the base price of each package, you can add on options. The best way to attack an account transfer is to first create a transfer in QuickBooks, as https://www.accountingcoaching.online/ the below media demonstrate. Then, when that transfer comes through your bank feed, you can match it to the corresponding account. If a reconciliation has too many discrepancies, reversing that reconciliation might be the best move.

The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash. Advanced also removes the limitations on the number of classes, locations, and charts of accounts, making it ideal for businesses with a growing staff. It also has a batch invoicing and expense management feature, which is ideal for those who manage a large volume of invoices and expenses daily.

Other Similar Publications:

- QuickBooks Desktop, Compare QuickBooks Desktop to Online

- The difference between an expense and an expenditure

- Church Management Software for Small and Large Churches

- EMI Calculator- Home, Car and Personal Loan EMI Calculation

- Accounting Reconciliation: What It Is, How to Do It, and Best Practices

- Obtaining an ITIN from Abroad Internal Revenue Service

- Sales tax calculator for 94538 Fremont, California, United States in 2024

- What Does M And MM Mean In Accounting?

- Solved: How do I manually enter employer payroll liabilities into Quickbooks online?

- QuickBooks Online Pricing And Plans 2024 Guide

- Accounting for Property Managers: Beginner’s Guide 2024

- In: Bookkeeping